As an important category of PCB, FPC has the advantages of high wiring density, light weight, thin thickness, foldable bending, three-dimensional wiring, fast heat dissipation and other types of circuit boards. It is more in line with the intelligentization of electronic products in downstream industries. The development trend of thinness and portability is widely used in modern electronic products.

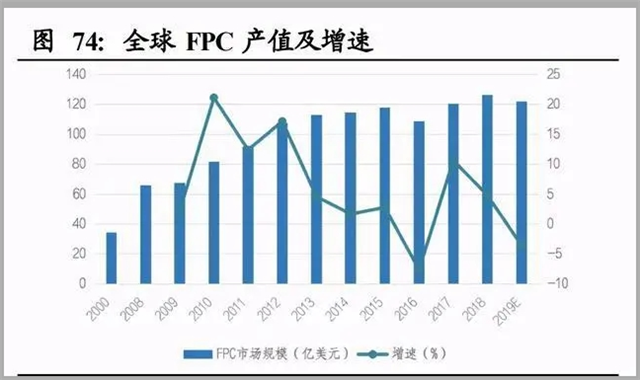

According to Prismark statistics, in 2008, the output value of flexible circuit boards was 6.6 billion U.S. dollars. By 2018, the global FPC output value reached 12.8 billion U.S. dollars, and the CAGR reached 6.8%. It is estimated that the global FPC output value in 2022 will be 14.9 billion U.S. dollars, which will achieve a CAGR of 3.5%. At present, the global FPC output value accounts for nearly 20% of the entire PCB industry output value. It is estimated that in 2022, the global FPC output value will account for approximately 21.6% of the entire PCB industry output value.

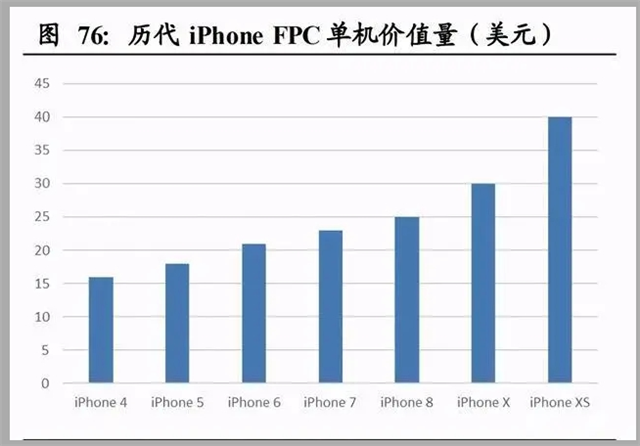

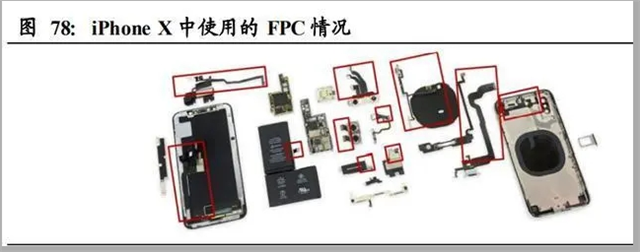

iPhone X launched in 2017 brought a comprehensive upgrade of components, such as OLED full-screen, True Depth 3D camera, LCP antenna, etc., further leading the increase in FPC stand-alone usage. The FPC stand-alone usage in the iPhone 4 is only 10 pieces, while the stand-alone FPC usage in the iPhone XS has grown to 24 pieces; at the same time, the stand-alone value has increased from the iPhone 4’s 16 dollars to the iPhone XS’s 40 dollars. At present, the application scope of FPC in iPhone includes: camera module, earpiece, microphone, side button, volume button, speaker, motor (taptic engine), wireless charging, antenna, battery, lighting interface, screen module, touch module Wait.

From the comparison of FPC stand-alone usage, it can be found that Huawei, OPPO, Google, Vivo and Samsung flagship FPC stand-alone usage is about 10-15 pieces, which is less than 1/2 of the iPhone XS FPC usage. We expect that with the innovation of smartphone functions, the usage and value of FPC in Android phones are expected to increase further, replicating the growth path of FPC usage and value in Apple phones.

Increased automotive electronics has led to an increase in demand for automotive FPC

Consumers have higher and higher requirements for car comfort and safety. With the rise of autonomous driving, people's demand for connectivity and infotainment has become more prominent, and the cost of automotive electronics as a percentage of the total vehicle cost has gradually increased. According to Prismark statistics, in 2009, the output value of automotive PCB products was approximately US$1.5 billion, accounting for 3.7% of the overall PCB output value. By 2017, the proportion increased significantly to 8.8%, reaching US$5.2 billion. In terms of growth rate, the automotive PCB industry is expected to achieve a compound growth rate of 4.1% in 2017-2022, which is higher than the industry average of 3.2%. PCB is widely used in automotive electronics, mainly in power control systems, safety control systems, body electronic systems, and entertainment communications.

According to NTI data, the PCB usage and value of different car models vary greatly. The PCB value of the mid-to-low-end models is about 30-70 USD, and the PCB value of luxury cars is as high as 100-150 USD. In addition, the value of PCBs for bicycles increased from US$16-24 in 2013 to US$62 in 2016, with a CAGR of 45.81%. Automotive FPC demand accounts for approximately 15% of automotive PCB demand. At present, automotive FPCs are mainly used in LED lights, gearboxes, BMS, on-board display screens, and infotainment systems.

New energy vehicles emphasize smart manufacturing, and the core demand is cruising range. FPC can replace the wiring harness to reduce weight, thereby achieving increased cruising range with the same battery capacity.

Three of the top five manufacturers are Japanese manufacturers, namely Chisheng, Fujikura and Sumitomo Electric. In 2017, Pengding’s FPC revenue surpassed Qisheng and became the world’s largest FPC manufacturer, with a current market share of approximately 25%. Japanese FPC manufacturers have poor profitability and have no incentive to expand production. The epidemic has accelerated the decline of Japanese FPC manufacturers. This is mainly due to the low efficiency of investment decision-making of Japanese manufacturers, and it is difficult to keep up with the iterative speed of consumer electronics. In recent years, Japan's FPC output value and output have both experienced a significant decline, and the market has shrunk more severely. Since 2020, Japanese FPC manufacturers' factories in Southeast Asia have been affected by the epidemic at a low operating rate, and Japanese FPC output value and output have fallen sharply.

Cost advantage + improvement of the upstream and downstream industrial chain continues to promote the transfer of production capacity to the mainland, and Chinese FPC manufacturers are actively expanding production to respond. Compared with the higher environmental protection expenditures and labor costs in developed regions, the mainland’s looser environmental protection policies and lower labor prices can provide manufacturers with cost advantages; in recent years, my country’s PCB/FPC upstream and downstream industrial chain has gradually improved, and the upstream PCB/FPC The supply chain of raw materials required in the production process has been formed. The downstream consumer electronics, automotive electronics and other markets are developing rapidly, and with the impact of the epidemic, the process of FPC production capacity transfer to my country is accelerating. It is recommended to pay attention to the FPC industry chain.